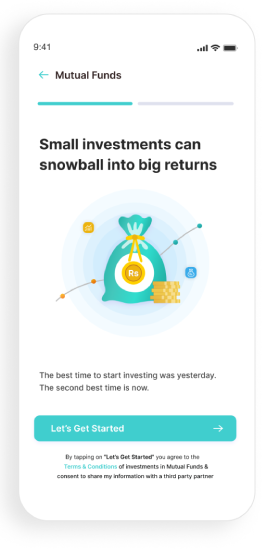

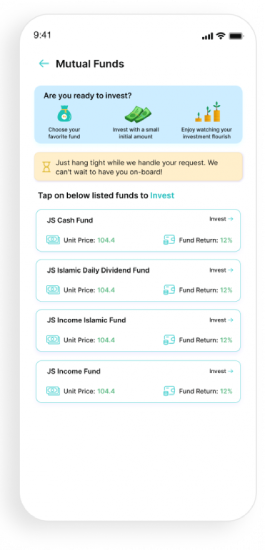

A mutual fund is an investment portfolio managed by professional fund managers for many investors. You can kick back and relax while we generate profits for you.

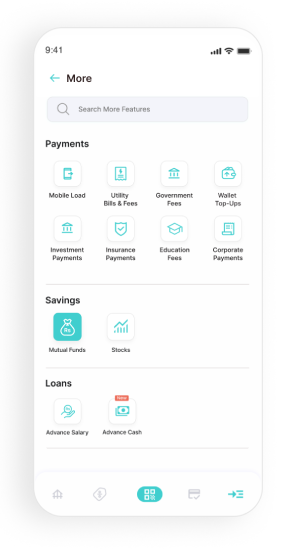

Mutual funds make saving and investing simple, accessible, and affordable. The advantages of Mutual Funds at Zindigi include the following:

Yes, Zakat will be deducted at the time of redemption or on the profit earned on Mutual funds. If you want Zakat to not be deducted, please submit “Zakat Exemption Declaration” Form (CZ-50) before 1st of Ramazan via Zindigi app.

You can contact us through

You will be issued a system generated Account Statement which will be a proof for your investment with mutual funds through Zindigi.

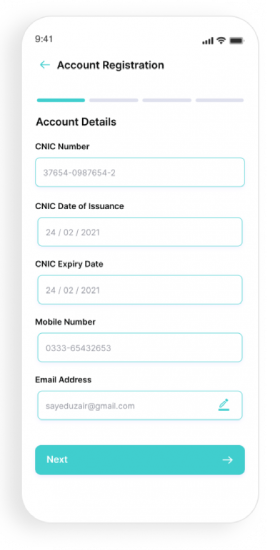

No, you don’t have to create a separate account for mutual funds. We will receive your application automatically once you apply for mutual funds at Zindigi.

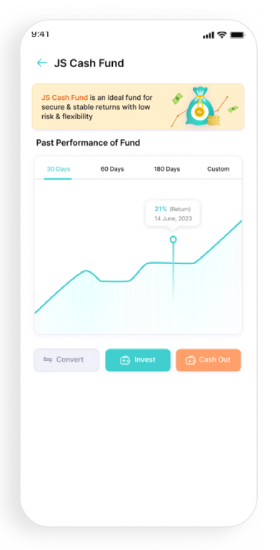

You can find the convert option next to invest option once the investment is done. You can convert from one fund to another fund any time by following the guideline given below:

It will take 2-3 working days to show conversion of funds on your portfolio.

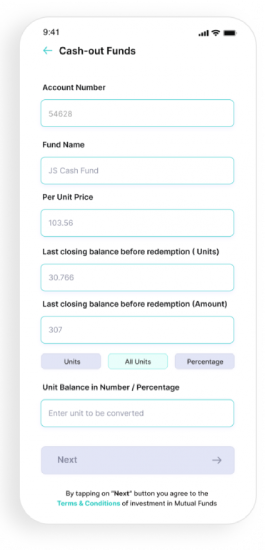

You can perform the cash out option from your investment in mutual funds at any time. You have the option to withdraw the complete amount, or any amount based on your requirements by following the guide:

It takes upto 2-3 business days to transfer your funds to your respective Zindigi Account.

Deducted amount is not shown instantly, it can take upto 2-3 business days to be shown in your investment portfolio

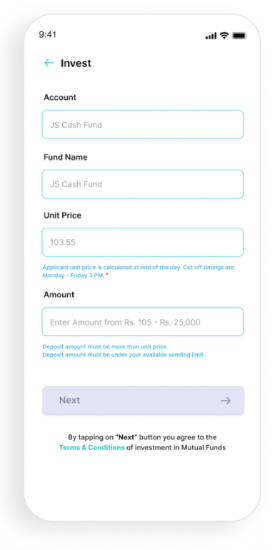

The minimum amount you can invest /withdraw in a single transaction is a unit price of a fund while the maximum is PKR 25,000 per day.

Maximum annual investment limit can be up to PKR 100,000 during last one year, starting from the date of account creation and this limit will be reset every year. In case of withdrawal during the year, the annual limit will prevail as per the utilization will not be reset.

Maximum cumulative investment limit. i.e. net investment in flow is PKR 200,000 at any point in time

No, you cannot invest more even if you have withdrawn the amount.

Yes, a platform fee of Rs. 5 will be charged on every redemption regardless of redemption amount.

© Zindigi.pk 2025. All Rights Reserved.

Design & Developed by: inspurate.com